Mobile banking is gaining much popularity among smartphone users today. Thanks to the introduction of mobile banking apps, millennials are accustomed to managing money online without visiting the bank. Most people, irrespective of their age, are comfortable in doing online banking in the comfort of their own place anytime. A recent survey showed that over 32 percent use mobile banking applications to make payments online.

IDFC FIRST Bank offers the best banking facilities through its well-designed banking app. Some of them to mention are:

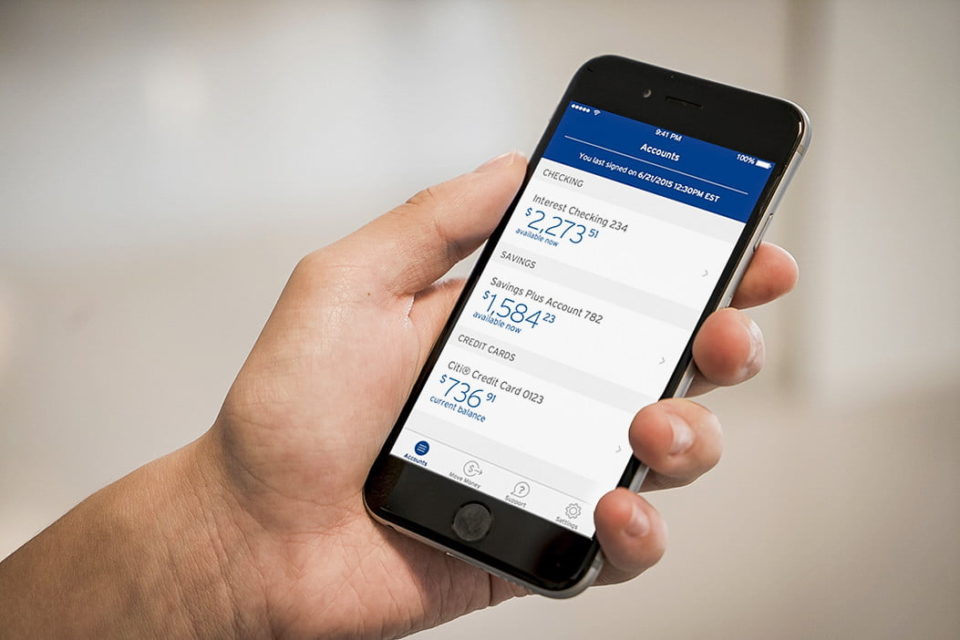

- View your bank account balances from one place

IDFC FIRST Bank allows its customers to access their bank account through a well-designed mobile banking app. It helps you link all your savings bank accounts and track the balances when you want them. You can log on to your IDFC FIRST Bank mobile app from anywhere and keep track of all transactions like money transfers, deposits, and payments. The app also gives you a snapshot of your account, generates and views bank statements, and monitors any suspicious activity. You can stay organized as you will know where your money is going.

- Easy money transfers via any payment mode

One of the prime reasons for the increase in the number of smartphone users is these devices help transfer funds easily via an online banking app. The IDFC FIRST Bank’s mobile app enables one to move funds from your bank accounts to other accounts within the same or different banks instantly. You can transfer money or make payments using the NEFT, RTGS, or IMPS mode by registering the beneficiary’s name or using the ‘One-time beneficiary option’. Using this facility, you can send money safely and receive instant confirmations.

Then, you can also use the BHIM UPI payment app to transfer money instantly, without registering the beneficiary name.

- Pay your bills on time

With the IDFC FIRST Bank net banking app, you can pay your bills on time. The app enables you to handle all your utility payments for services such as cooking gas, electricity, water, and mobile phone charges easily. You can also plan your credit card bill payments and loan repayments by using the ad-hoc payment option, which allows you to fix the amount and payment frequency.

You can also set up ‘Auto Pay’ to pay the utility bills, wherein you can pay the entire amount in a single transaction. With ‘QuickPay’, you have another option to make payments instantly.

- Avail of a personal loan online

You can also use the IDFC FIRST Bank mobile banking app to borrow money online. The instant loan app helps you apply for a personal loan by filling in some basic information. Before applying for an instant loan, you can check your eligibility online. The process requires you to fill out your personal details and upload the supporting documents for verification. Once it is completed, the sanctioned amount will be credited to your bank account immediately.

- Manage your money easily

There are a few banking apps that help you with better money management. IDFC FIRST Bank’s mobile app helps you get your entire financial picture in one place. Using its smart features, you can categorize transactions, link credit and debit cards, create a budget, and track your spending. Moreover, it also gives you suggestions to invest money in mutual funds and fixed and recurring deposit schemes.

IDFC FIRST Bank, through its unique mobile banking app, redefines your personal banking experience when you use it every time.